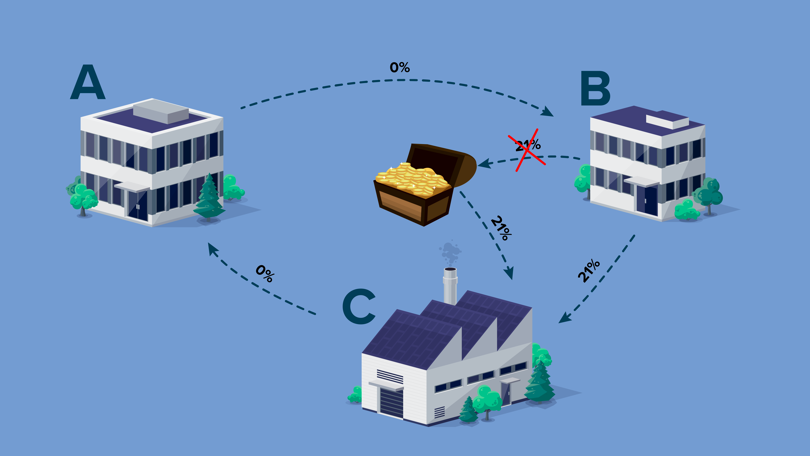

Example of VAT carousel fraud

The following simple example involves three companies: A, B (the fraudulent company), and C. In this case, Company A is based in France, and Companies B and C in Belgium. Suppose that Company A supplies goods to Company B; it does not have to charge VAT for this because it is an intra-community supply (a cross-border supply within the EU). Company A also does not have to remit VAT to the authorities.

If Company B then sells the same goods within Belgium to Company C, it will have to charge VAT for this and remit it to the VAT Authority. Should Company B decide not to declare VAT, then this company is fraudulent. In such a case, we refer to it as a leak.

Company C will be entitled to deduct the VAT on the goods purchased on its VAT return. If Company C then sells the goods back to Company A in France, then (as with the first intra-community supply) no VAT will be charged and the carousel can start all over again.

The fraudulent company in a VAT carousel (Company B in our example) is also known as the missing trader or 'buffer'. Such companies are usually set up solely with a view to defrauding and are often completely ‘emptied’ over time.

ResourcesSupportAbout us

ResourcesSupportAbout us